Contributed by:

Charles R. Goulding,

President, R&D Tax Savers

www.rdtaxsavers.com

Twitter | LinkedIn | Facebook

This is Part 1 of a guest post series. Check out the other posts in this series on Tax Credits for the Lighting Industry. Views expressed are those of the author and the firm they represent. Representatives of R&D Tax Savers have presented at the LightFair Conference in the past.

Rewarding Lighting Innovation with Tax Credits

One of the exciting characteristics of the lighting industry is that from the time of Edison, Westinghouse and Tesla the lighting industry has continuously innovated. The policy of the U.S. Federal Government and over 40 states is to reward that innovation with R&D tax credits for qualified research expenses (QREs).

The activities that create QREs are expenses related to:

1. New and improved products and designs, and;

2. New improved manufacturing and business processes, including a broad category of software projects

The types of lighting companies that obtain R&D tax credits include lighting manufacturers, electrical contractors and lighting designers—which also includes architects and engineers.

Does Your Lighting Innovation Qualify as New?

Qualifying projects do not have to be new to the world, only new or improved to the lighting company claiming the credit.

Haitz’s law – the lighting industry’s corollary to Moore’s law – embodies the concept that lighting technology is constantly improving. Haitz’s law predicts a continuous exponential improvement in lighting technology. This is supported by constant miniaturization and performance increase results in both smaller and more powerful LED lighting technology, enabling the industry to perpetually develop the next new level of innovative products.

Expenses That Qualify for Tax Credits

There are three types of expenses that generate R&D tax credits.

- Wages paid to engineers and designers, CAD and 3D printing professionals, QC experts and technicians, including testing and lab technicians, are often the largest driver of eligible expenses. New lighting products require substantial testing with a wide variety of methods.

- Supplies, meaning raw materials consumed while making new products and prototypes, qualify for the credit. This includes cloud charges related to software development.

- Lastly, a large eligible expense category for the lighting industry includes third-party contractors such as engineers, outside testing organizations such as Underwriters Laboratories and outside software integrators related to numerous business organizations.

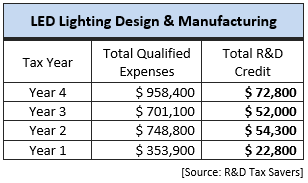

Sample R&D tax credit results for a small lighting designer are presented below:

The lighting industry is a constantly changing dynamic industry. In order to both stay relevant and grow, the lighting community must innovate.

The lighting industry is a constantly changing dynamic industry. In order to both stay relevant and grow, the lighting community must innovate. Federal and state R&D tax credits are available to support the innovation process.

There is still time to get the 2020 credit on your unfiled 2020 tax return. If you are looking to take advantage of this credit, consider consulting with an R&D tax credit expert to get started.